Equifax Breach and Your Personal Information

The Equifax data breach exposed the personal information of over 143 million people between May and July 2017. In that time, information was leaked exposing people’s names, Social Security Numbers, addresses and even some driver’s license numbers. As a financial institution, we take this news very seriously. We always want to ensure our members are well informed on the steps to take to protect themselves and their families.

We recommend you check to see if your information was compromised by visiting www.equifaxsecurity2017.com. This site outlines Equifax’s strategy for dealing with the breach. It also allows you to check whether you may be at risk for future identity theft and enroll for free protection to monitor your information. This protection reviews credit reporting and activity that appears mysterious or atypical. In the event of questionable activity, this monitoring protection will notify you so that you are able to take appropriate action.

As technology continues to evolve and self-service options become more widely available, it is important to always take steps to protect your information. These include:

- Stay Vigilant On The Phone. A trusted institution will never call you to ask about your personal information. However, when you place the phone call, a service representative may ask to verify your information. These measures are put in place to validate your identity.

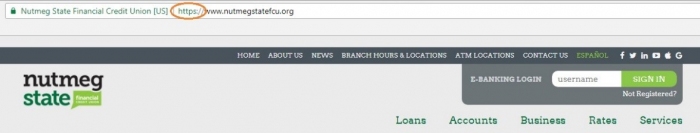

- Check websites. More often than not, websites that utilize your personal information will have a URL that begins with https://. The “S” stands for secure and keeps the risk of fraudsters minimized. If you are asked to put in any type of personal information online, make sure the website starts with https://.

- Review your credit report. You are entitled to one free credit report annually. Visit www.annualcreditreport.com to regularly review the information on your report. Ensure there is no suspicious activity. Some people have also opted to put a freeze on their credit file. This enables you to restrict new credit applications under your name. Find out more about adding a security freeze.

- Enroll in credit monitoring. Think of credit monitoring as an insurance policy that helps keep an eye on your information. Credit monitoring provides protection against identity theft by monitoring your credit report for new activity. If any new activity occurs, you will receive an alert which has been triggered by a change in your credit file. The alert will provide details on the type of activity which has triggered the change, for instance, a new credit account, application for any type of loan, or change of address. Providing active monitoring on your credit report will ensure identity theft is recognized quickly. This service is only $2.95/month with Nutmeg. Find out more or enroll now.

- Set up e-Alerts. You can also set up alerts for all your Nutmeg accounts. These text or email alerts will let you know in real time when a transaction occurs on your account. You can create alerts for all transactions, or customize to be only for specific transaction types. For instance, you can set alerts specific to low balances, debit or credit card usage, insufficient funds notification, and much more. Find out more about our e-Alerts.

We want to help keep you protected from ID theft and fraud. In the case that you are ever a victim, we can help you recover. Nutmeg offers ID Theft Protection Service for a low monthly cost. For only $1.95/month, you can have peace of mind. Nutmeg and our trusted team will work for you in the event of identity theft. To learn more about our ID theft Protection Service, click here. You may already be enrolled in this service. If you are not sure, please contact us.

We are always happy to answer any questions you might have about your accounts, identity theft risks or other potential concerns. If you ever suspect any tampering with your Nutmeg accounts, please contact us immediately. We want to help make sure things get back to normal as quickly as possible for you.